The best travel insurance providers for Thailand trips in 2025

Congratulations on even making it to this page!

We get it, buying insurance for a trip is the single worst part of the planning process, but it’s also one of the most important.

You’ve already got the hardest part out of the way — sitting down to do it — the rest of it is usually much easier than you anticipate.

If you just want to know where to go to purchase solid coverage, we recommend SafetyWing because their pricing is competitive, and unlike other sites, they are upfront about what activities are covered and which are not. Their basic policy includes coverage for motorbikes which can be difficult to find.

Important: SafetyWing advertises itself as “Nomad Insurance” targeted at digital nomads and remote workers. They work on a monthly subscription model by default, but if you have a trip with start and end dates just tick the “specific travel dates” box and you’ll be buying traditional travel insurance.

Get a quote

Get a quote quickly here, or keep reading to find out why we recommend SafetyWing and details on coverage for motorbikes, adventure sports, Muay Thai etc.

Why you need insurance

Since you’re already on this page, you probably know why you need insurance. You most likely won’t use it, but if you have to, you’ll be very glad you have it. That’s pretty much the point of insurance.

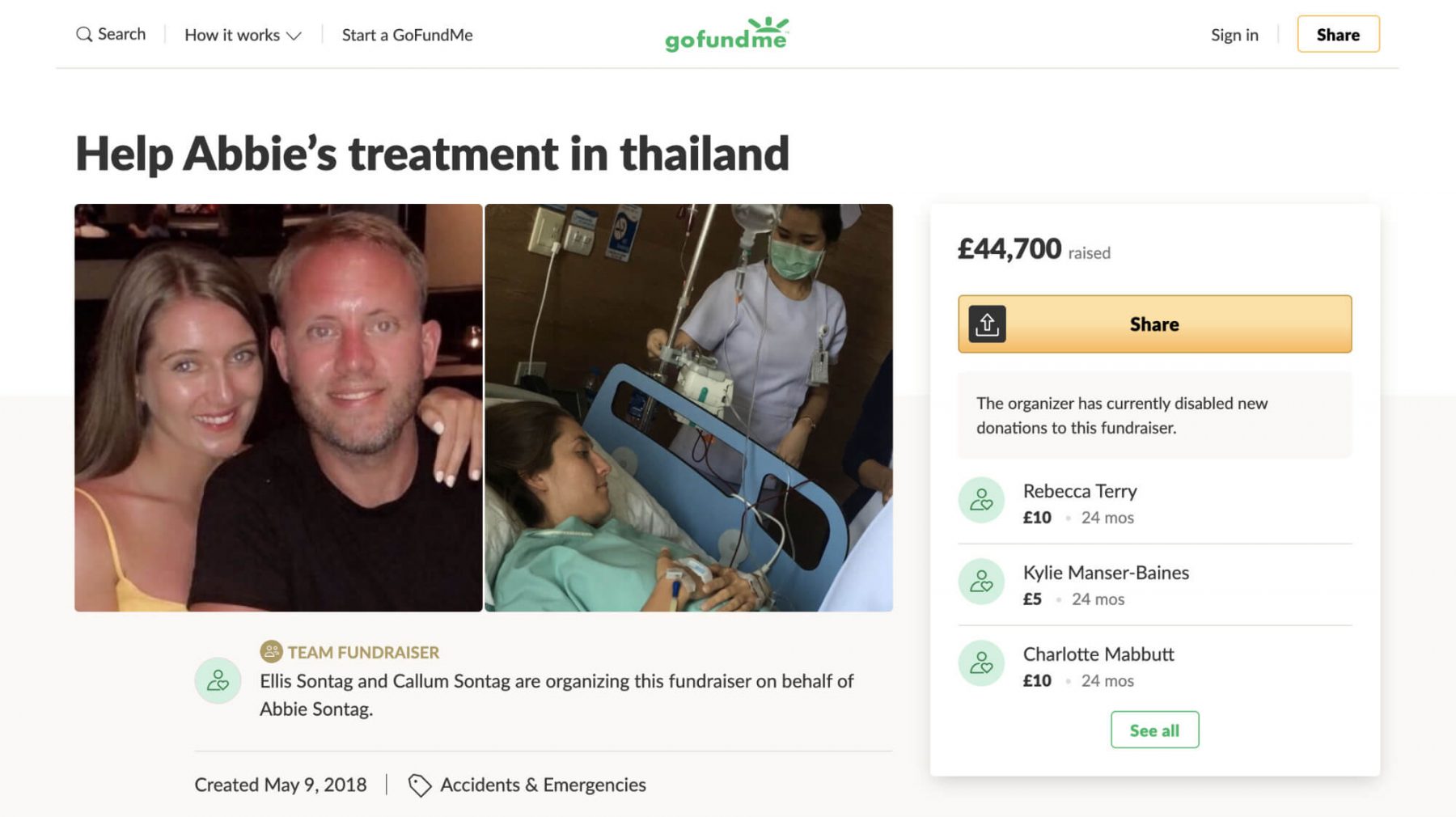

Millions of people travel around Thailand every year with no travel or health insurance, and most of them get away with it. But thousands of people also get stuck with huge medical bills leaving them begging family at home for money, or turning to sites like Go Fund Me to raise cash.

In some cases, not having insurance coverage costs people their lives. The private hospitals that provide the best care in Thailand are businesses. If you are in an accident, you can expect a basic level of care, but the reality is that major emergency surgeries and medical evacuations are reserved for people who can pay for them.

In 15 years of traveling in Thailand, I’ve met dozens of people who were at a minimum saved from massive medical bills by having insurance.

My friend Gavin even owes his life to having travel medical insurance. He had a motorbike accident in a rural area in Northeastern Thailand. It was only for his insurance which got him an emergency evacuation to Bangkok that he is still alive today.

Insurance is not that expensive. Just think of it as a necessary expense of your trip, no different than your flight or hotels. You pay for it up front, then it’s out of sight, with peace of mind.

Important: You may already have travel insurance coverage. If you have private health insurance in your home country, they may provide enough medical cover for your trip. Certain credit cards also provide some medical coverage, and many of them give trip cancellation coverage when you book with that card. Your home or renters insurance might also cover your belongings while on the road. Check your policy guide, or give them a call to see if you are already covered.

What coverage do you need?

There are a lot of different types of insurance that cover different things, but in general, travel insurance can cover:

- Medical emergencies

- Medical evacuation

- More minor health issues

- Trip cancellations

- Loss or damage of your personal belongings while traveling

The first two are by far the most important. You can probably do without the others, but having coverage for medical emergencies and evacuations is crucial. SafetyWing policies do include some coverage for delay and cancellations, and loss or damage of personal belongings.

If you want to shop around we like the site SquareMouth which aggregates policies from a number of different providers. Depending on your personal needs you may find a better option that from SafetyWing. It’s harder to tell what adventure sports/motorbike exclusions there are with these policies though which is why we personally avoid them.

Note: If you are an American, it’s pretty easy to get good insurance coverage for your belongings, and for trip delays and cancellations through a good credit card. Check out our guide to the best credit card for traveling abroad to learn more.

Our top provider recommendation

We’ve spent more hours than we’d like to admit browsing dozens of travel insurance aggregation websites trying to find the best one (or the least bad one). We’ve concluded that SafetyWing is the easiest site to use to shop around for a travel insurance quote.

Enter in just a few personal details like your age and home country or US State, and where you plan to travel, and within a minute you can have the most competitive plans listed. Use the filters to set minimum coverage amounts to make sure you have good enough coverage.

Insurance coverage for motorcycles and adventure sports in Thailand

It can be really difficult to find coverage for motorbikes, and even when you think you may have it, a lot of providers use fine print to make it diffcult to actually tell. That’s why we recommend SafetyWing. They are totally upfront about what they cover.

SafetyWing offers their basic policy which includes motorbike coverage, but certain other common activities travelers to Thailand might want to do are excluded unless you add on adventure sports coverage (currently $10 per month for travelers under 40.

Some of these excluded activities include Muay Thai and all boxing and martial arts, cave diving, dirt bikes and ATVs, kitesurfing, and whitewater rafting.

Your motorcycle coverage will only work if you have a valid motorcycle license in your home country and carry an international driver’s permit with it (or you have a Thai motorcycle license). You must also be following all laws at the time of any accident, so you have to wear a helmet and not be intoxicated.

Better safe than sorry

It’s fairly unlikely you’ll need to use your insurance, but if you do, you will be glad you have it. It might save you tens or even hundreds of thousands of dollars, and a huge amount of stress and aggravation. It might even save your life. It’s worth it, get it.

Important: Final note: Sadly, all insurance providers kind of suck and will sometimes try to weasel out of paying a claim, or hide exclusions in the fine print. We cannot take responsibility for any info in this guide being 100% true all of the time since ultimately the only thing that is legally binding is the policy contract. Also, we are experienced travelers, not lawyers or insurance experts. Be sure to do your due dilligence and read through any policy. Buying from a reputable insurer is a good idea too since some are definitely better than others. SquareMouth shows the ratings of each provider right on the search page which we find useful.

Disclosure: This page has some affiliate links. If you click one of these links and make a purchase or booking, we will earn a small commission. This is 100% free for you and it helps us to continue creating great Thailand content that we can offer to you for free.